Which Describes the Difference Between Secured and Unsecured Credit

Secured credit cards offer a lower credit limit. When a credit is extended without any collateral security or prime security is it unsecured.

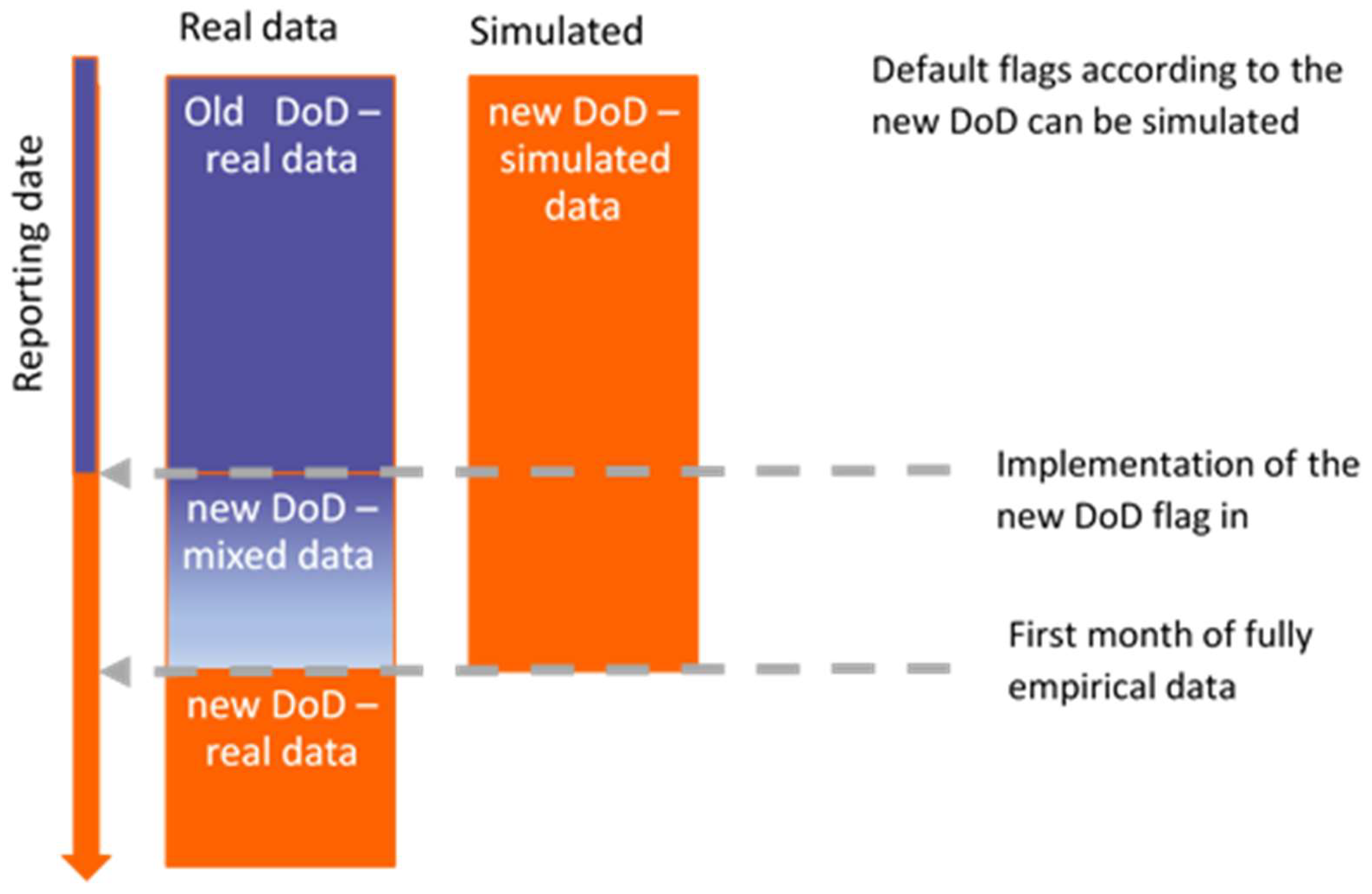

Risks Free Full Text New Definition Of Default Mdash Recalibration Of Credit Risk Models Using Bayesian Approach Html

In contrast an unsecured credit card can range from a low credit limit to a 20000 limit or unlimited spending amount.

/Paycreditcarddebt-d3d67e258ffa4587965ef12f24f19c13.jpg)

. Apart from this security deposit secured and unsecured credit cards arent necessarily better or worse for your credit. Secured credit is backed by an asset equal to the value of a loan while unsecured credit is not guaranteed by a material object. An unsecured line of credit is not guaranteed by any asset.

Depending on how the bank or financial institution chooses to report this to the bureau your credit. Though secured credit cards require a deposit and do not offer rewards they still can be a better option for people in some circumstances. What are Secured Credit Cards 3.

The main difference between Secured and Unsecured credit cards is that they are based on different methods of issuance or their qualifications. Secured cards rarely offer rewards. Thereof Which describes a difference between secured and unsecured.

Unsecured credit is backed by an asset equal to the value of a loan while secured credit is not guaranteed by a material object. Example credit cards student loans personal loans. Unsecured credit enables lenders to seize an asset if a loan is not paid while secured credit prohibits.

Plus unsecured cards typically offer rewards programs that can be worthwhile. Can be highlighted in credit report. Overview and Key Difference 2.

The main difference between a secured credit card and an unsecured credit card is that secured cards require you to place a refundable security deposit when you open your account. As Charles Dickens describes it credit sounds like a marvelous and miraculous thing. The key difference between secured and unsecured credit card offerings is whether a deposit is required.

Secured credit is backed by an asset equal to the value of a loan while unsecured credit is not guaranteed by a material object. It doesnt quite work like that though. Unsecured credit enables lenders to seize an asset if a loan is not paid while secured credit prohibits lenders from taking.

One example is a credit card. Unsecured credit is backed by an asset equal to the value of a loan while secured credit is not guaranteed by a material object. You can often find a rewards program to suit your interests like travel miles cash back and more.

Secured credit is risky because banks cannot seize assets while unsecured credit is less risky because it is backed by material objects. The key difference between secured and unsecured credit card is that a secured credit card is a card that is safeguarded against a form of collateral whereas an unsecured credit card is a card that is not protected against a form of collateral. Providing collateral or making a deposit is essential to the issuance of secured credit cards.

Secured credit cards require you to make a security deposit to qualify while an unsecured credit card does not. Secured credit is risky because banks cannot seize assets while unsecured credit is less risky because it is backed by material objects. Unsecured credit is backed by an asset equal to the value of a loan while secured credit is not guaranteed by a material object.

A secured credit is secured by something else. Secured credit is risky because banks cannot seize assets while unsecured credit is less risky because it is backed by material objects. Unsecured credit always comes with higher interest rates because it is riskier for lenders.

Unsecured credit is backed by an asset equal to the value of a loan while secured credit is not guaranteed by a material object. The credit limit on a secured credit card is usually up to 90 of the deposit kept as collateral so is likely to be much lower than the limit offered on an unsecured credit card. Heres a look at the difference between secured and unsecured.

A secured line of credit is guaranteed by collateral such as a home. A secured credit card does require some form of collateral associated with the account. These are given only depending on the reputation of the borrower without any other security to be sold in case of default.

Unsecured cards usually offer lower interest rates than secured credit cards. This deposit makes the credit card secure Typically the cash deposit equals the card limit. Unsecured credit enables lenders to seize an asset if a loan is not paid while secured credit prohibits lenders from taking.

Get Organized To File Bankruptcy Bankruptcy Getting Organized Organization

Types Of Loan By Adiloans 91 7290090485 Online Lending Types Of Loans Instant Loans

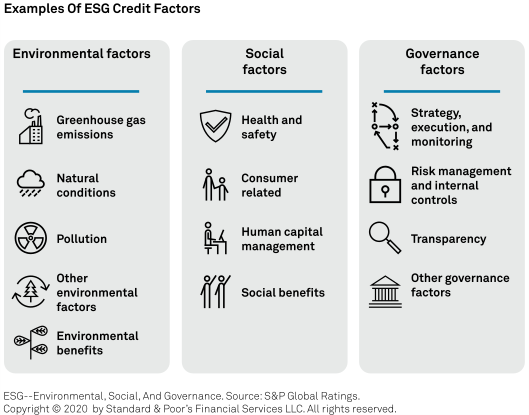

Sustainable Covered Bonds Assessing The Impact Of Covid 19 Ecbc

Which Is Better When You Are Rebuilding Your Credit Unsecured Credit Cards For Bad Credi Rebuilding Credit Small Business Credit Cards Credit Card Payoff Plan

Small Business Loan In Delhi Ncr Small Business Loans Business Loans Small Business

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

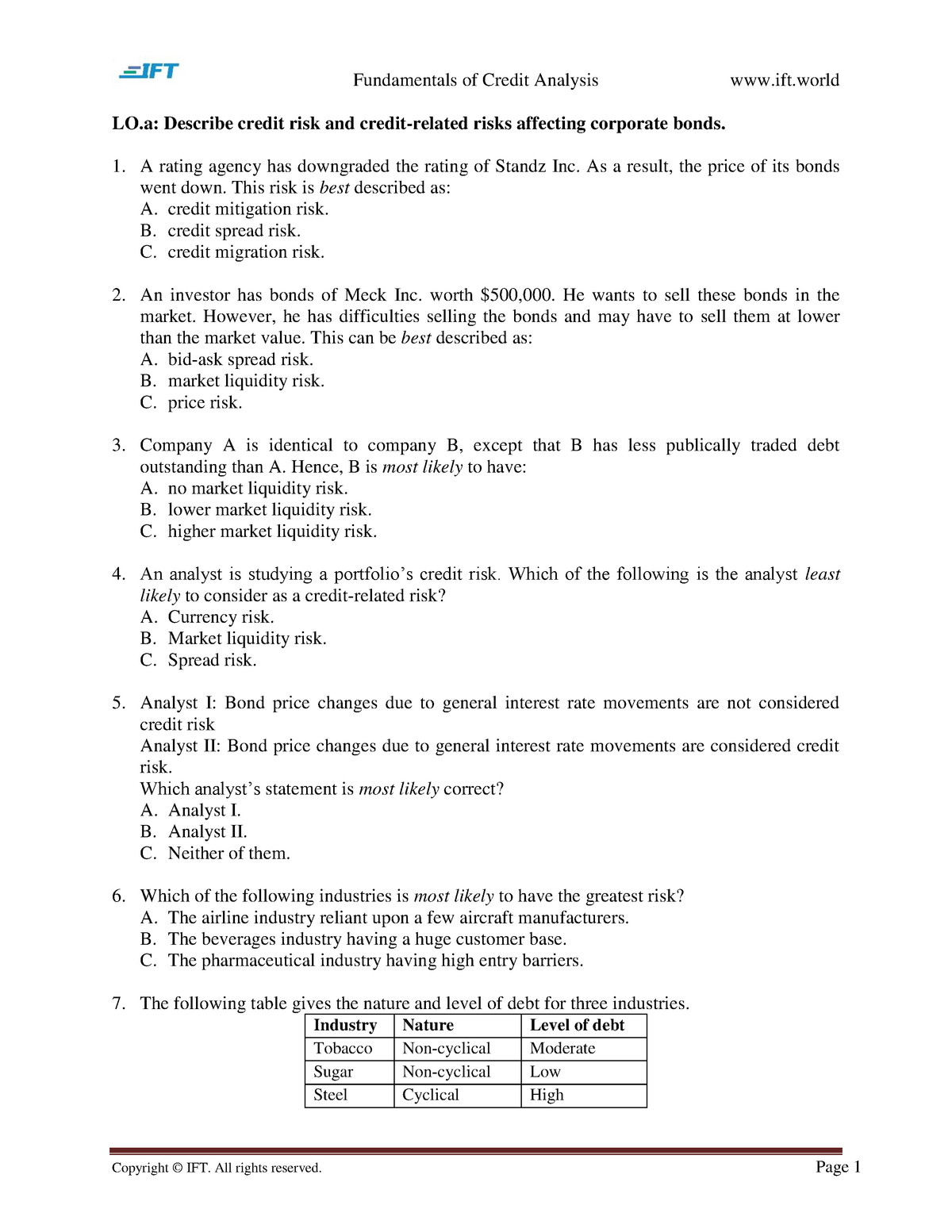

R56 Fundamentals Of Credit Analysis Q Bank Corporate Finance Studocu

Expense Budget Templates 15 Free Ms Xlsx Pdf Docs Budget Template Budgeting Templates

Should I Refinance My Car Car Loans Car Car Finance

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/Paycreditcarddebt-d3d67e258ffa4587965ef12f24f19c13.jpg)

Secured Vs Unsecured Lines Of Credit

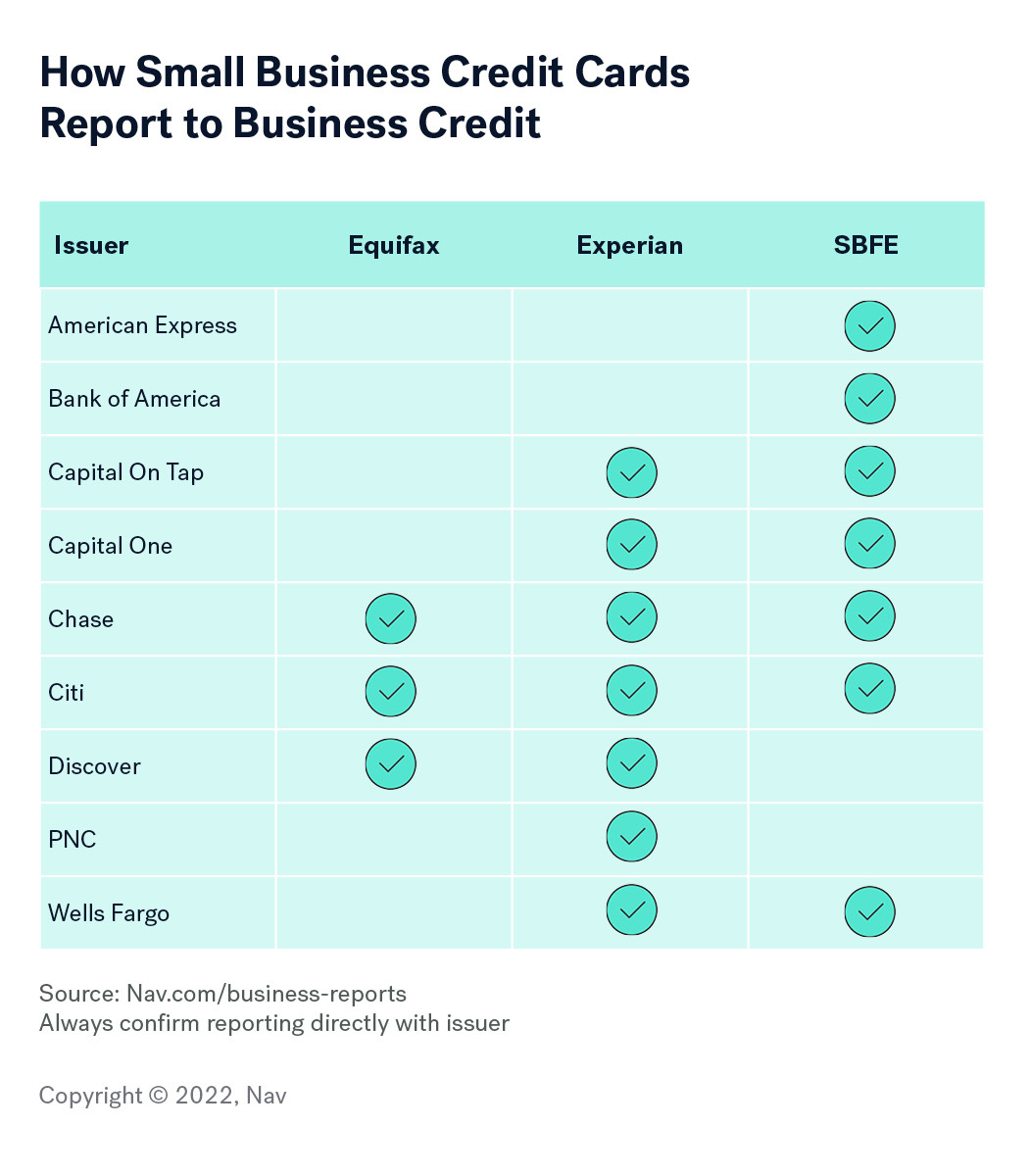

Best Business Credit Cards To Build Business Credit Nav

Personal Secured Loans First Exchange Bank North Central West Virginia

How To Pay Chinese Supplier By A Letter Of Credit To Protect Against Bad Suppliers Lettering Computer Maintenance Finance Class

The Fortune Teller By Dongkyu Lim Credit Restoration Tellers Fortune

What Is Credit And Why Does It Matter Lexington Law

How To Save Money 29 Easy Actionable Tips Paying Off Credit Cards Finance Money Problems

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

Comments

Post a Comment